Amazon India Removes Referral Fees for Products Under ₹1000: What This Means for Sellers (Till December 31)

If you sell on Amazon India, or have ever considered selling low-priced products on the platform, you’ve probably searched for this at least once:

“Amazon referral fee waiver under ₹1000”

Over the past few weeks, that search query has exploded.

The reason? Reports confirming that Amazon India has removed referral fees for products priced below ₹1,000, a move that immediately changes the economics of selling low-ticket items on the platform, at least for now.

But before sellers celebrate or redesign their entire pricing strategy, there’s one crucial detail that needs to be said clearly and upfront:

This referral fee waiver is currently applicable only till December 31.

It is not permanent. It is not universal. And it does not eliminate all selling costs.

This blog explains what Amazon’s referral fee waiver actually means, why Amazon made this move now, who benefits the most, and how sellers should realistically plan around it without falling into common traps.

Why Amazon Referral Fees Have Always Been a Pain Point

To understand why this move matters, you need to understand why Amazon referral fees have been such a big issue for Indian sellers, especially those operating in the sub-₹1000 price band.

Amazon charges sellers a referral fee, which is essentially a commission for using the marketplace. This fee is calculated as a percentage of the selling price and varies by category.

For example:

Fashion & lifestyle products often attract 15–20% referral fees

Home and kitchen products range between 12–18%

Accessories and everyday items usually fall between 8–15%

For a ₹499 or ₹699 product, this fee alone can wipe out a major portion of the seller’s margin.

This is why many sellers have historically avoided listing low-priced items on Amazon or listed them at artificially inflated prices just to survive.

Amazon India’s Referral Fee Waiver Under ₹1000: The Actual Change

According to industry reports, Amazon India has waived referral fees on products priced below ₹1,000, following a similar move by Flipkart to reduce seller commissions on low-ticket items.

Let’s be very precise here, because this is where misinformation usually begins.

What Is Confirmed (As of Now)

Referral fees are waived for products priced under ₹1,000

The waiver is valid only till December 31

The waiver applies only to referral fees, not other charges

What Is NOT Confirmed

There is no official statement calling this a permanent policy

There is no guarantee the waiver will continue after December 31

Other Amazon fees still apply as usual

This is best viewed as a time-bound strategic move, not a structural overhaul of Amazon’s fee model.

Why Amazon Made This Move Now

This decision did not come out of nowhere.

The Indian e-commerce market is currently seeing intense competition in the low-price, high-volume segment, where platforms like Flipkart, Meesho, and quick-commerce players are aggressively onboarding sellers and pushing affordability.

Three clear trends forced Amazon’s hand:

1. Seller Migration in Low-Ticket Categories

Many sellers had already started pushing:

Budget fashion

Accessories

Kitchen utilities

Small home items

away from Amazon due to tight margins.

2. Flipkart’s Zero-Commission Push

Flipkart’s messaging around “zero commission” for certain product ranges created strong perception pressure, even when the actual fee structures were complex.

3. Growth of Price-Sensitive Indian Buyers

India’s next wave of online shoppers is far more price-conscious. Winning them requires better seller economics, especially under ₹1000.

Amazon’s referral fee waiver is a response to these pressures, not a long-term charity move.

Clearing the Biggest Myth: Amazon Is NOT Free to Sell Under ₹1000

One of the most dangerous misunderstandings spreading online is the idea that Amazon India now charges “zero fees” for products under ₹1000.

That is simply not true.

The waiver applies only to referral fees. Sellers still pay:

Fulfilment fees (FBA or Easy Ship)

Closing fees

Shipping and weight handling charges

GST on Amazon’s service fees

Return and RTO costs

Ignoring these costs can quickly turn a seemingly profitable SKU into a loss-making one.

This is a mistake Rekonsile frequently sees when sellers react emotionally to marketplace announcements instead of analysing the full cost stack.

A Simple Cost Breakdown: Before vs After the Waiver

Let’s look at a realistic example.

Example Product

Selling Price: ₹799

Category: Home & Kitchen

Before the Referral Fee Waiver

Referral Fee (15%): ₹120

Fulfilment Fee: ₹95

Closing Fee: ₹25

Total Amazon Fees (excluding GST): ₹240

If your product + packaging cost is ₹420, your margin before ads is ₹139.

After the Referral Fee Waiver

Referral Fee: ₹0

Fulfilment Fee: ₹95

Closing Fee: ₹25

Total Amazon Fees (excluding GST): ₹120

With the same product cost of ₹420, your margin becomes ₹259.

That single change nearly doubles the contribution margin.

This is why sellers are paying attention, and why the waiver is genuinely meaningful.

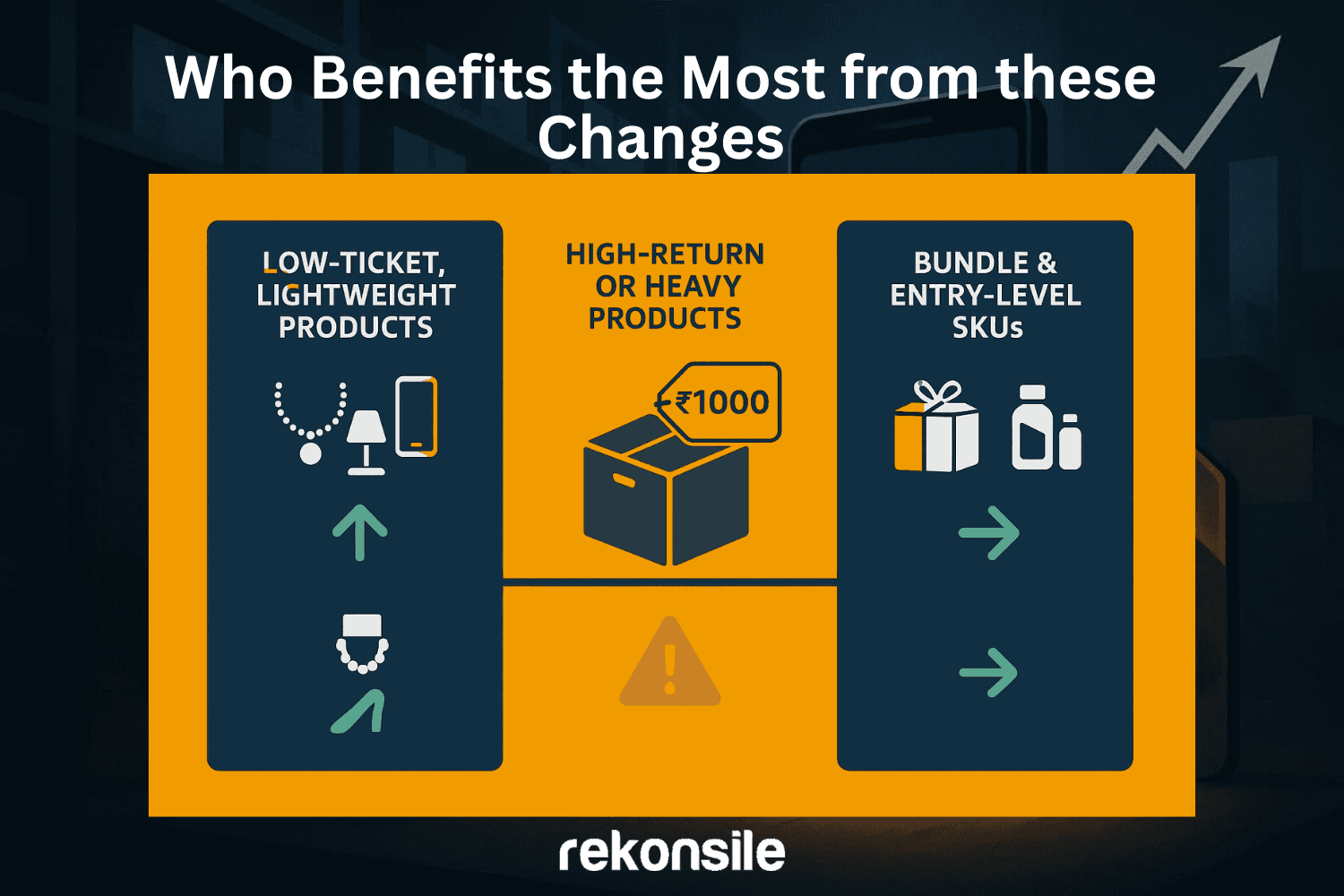

Who Stands to Benefit the Most from This Change

Not every seller will benefit equally.

Sellers Who Benefit the Most

Low-weight, low-return products

Categories with historically high referral fees

Sellers with tight cost control

Brands launching new budget SKUs

Sellers Who May Still Struggle

Heavy or bulky products

High return-rate categories

Sellers relying only on discounts

Poor inventory and reconciliation systems

Removing referral fees helps, but it does not fix operational inefficiencies.

Amazon vs Flipkart: Similar Headlines, Different Reality

Headlines often say “Amazon follows Flipkart,” but seller experience on both platforms remains very different.

Flipkart:

Aggressive seller acquisition

Focus on mass pricing

Higher operational tolerance

Amazon:

Stricter performance metrics

Stronger fulfilment ecosystem

More predictable fee logic

Amazon’s approach is more controlled, more temporary, and more data-driven. Sellers who understand this nuance can plan smarter instead of blindly copying strategies across platforms.

How Sellers Should Use This Window Till December 31

This waiver should be treated as a testing and optimisation window, not a permanent reset.

Smart sellers are using this period to:

Launch low-ticket SKUs they earlier avoided

Test pricing elasticity without referral fees

Improve AOV through smart bundling under ₹1000

Collect clean profitability data

At Rekonsile, sellers who use such windows strategically tend to emerge stronger even after marketplace policies change.

What Sellers Should Avoid Doing Right Now

Assuming the waiver will continue forever

Reducing prices without recalculating margins

Ignoring return costs

Scaling ads blindly

Marketplace policy changes reward disciplined execution, not panic moves.

What This Means for the Future of Low-Ticket Selling in India

Amazon’s referral fee waiver is not just a fee change , it’s a signal.

It signals:

Growing importance of budget commerce

Increasing seller bargaining power

Platforms fighting for long-term volume

But signals can change direction.

Sellers who build data clarity, margin visibility, and fee intelligence will always adapt faster , regardless of whether the waiver stays or disappears after December 31.

How Sellers Should Price Products During the Amazon Fee Waiver Window

One of the biggest mistakes sellers make during marketplace fee changes is reacting too fast.

The Amazon referral fee waiver under ₹1000 opens up multiple pricing possibilities, but not all of them are smart.

Instead of thinking “I can sell cheaper now, sellers should be asking:

“How can I extract maximum long-term value from this temporary margin expansion?”

There are three pricing approaches that are working well right now.

1. Hold Prices, Improve Margins

This is the safest strategy. If your product was selling at ₹699 or ₹899 earlier, keep the same price and let the additional margin strengthen:

Cash flow

Inventory turnover resilience

Ability to absorb returns

This approach is particularly effective for sellers in volatile categories like fashion and home, where return rates can swing unpredictably.

2. Strategic Price Drops (Not Discounts)

Some sellers are reducing prices by 5–8%, not to race competitors, but to:

Improve conversion rates

Increase Buy Box stability

Gain algorithmic visibility

This is very different from running a discount campaign. The goal here is conversion efficiency, not volume at any cost.

3. Smart Bundling Under ₹1000

Bundles are quietly becoming the biggest winners of this waiver.

For example:

Two ₹399 items bundled at ₹749

Three ₹299 items bundled at ₹899

Earlier, referral fees made such bundles unattractive. Now, they help:

Increase AOV

Reduce per-unit logistics impact

Lower return probability

Sellers who think in systems, not individual SKUs, are benefiting the most.

Why This Waiver Matters Even If You Don’t Sell Under ₹1000

Even if your core products are priced above ₹1000, this move still affects you.

Here’s how.

Entry-Level Products Become Feeder SKUs

Many brands are now using sub-₹1000 products:

Customer acquisition tools

Brand trial items

Review-generation SKUs

Once customers enter the ecosystem, higher-priced products see better trust and conversion.

Competitive Pressure Will Increase

As more sellers find profitability under ₹1000, competition will intensify. Sellers who previously stayed out of this segment may enter aggressively, reshaping category pricing.

Algorithmic Preference for Volume

Amazon’s algorithms tend to favour listings with:

Higher order velocity

Better conversion rates

Stable fulfilment metrics

Low-ticket items often drive these signals, indirectly benefiting a seller’s entire catalogue.

The December 31 Question: What Happens After the Waiver Ends?

This is the question most sellers are avoiding, but it’s the most important one.

There are three realistic possibilities once December 31 passes.

Scenario 1: The Waiver Gets Extended

If Amazon sees:

Strong order growth

Seller retention

Competitive pressure continuing

The waiver may be extended quietly, possibly category-wise.

Scenario 2: Partial Rollback

Amazon may:

Reintroduce referral fees at reduced rates

Keep the waiver only for specific categories

Change the price threshold.

This is the most likely scenario based on historical marketplace behaviour.

Scenario 3: Full Reversal

If unit economics do not work for Amazon, referral fees could return to pre-waiver levels.

Sellers who built pricing assuming permanence would struggle the most.

How Smart Sellers Are Preparing for January (Without Panic)

Experienced sellers are already preparing for all three scenarios.

Here’s what they’re doing differently.

They’re Tracking SKU-Level Profitability

Instead of looking at monthly totals, they’re tracking:

Per-SKU contribution margin

Return-adjusted profitability

Ad cost per converted order

This makes it easier to switch pricing quickly if fees return.

They’re Avoiding Permanent Price Anchoring

Dropping prices too aggressively now can make it hard to increase them later.

Smart sellers are:

Testing temporary adjustments

Using bundles instead of single-SKU price drops

Keeping MRP logic intact

They’re Strengthening Backend Visibility

When fee structures change, reconciliation errors increase.

Sellers who already have clarity on:

Actual fees charged

Referral fee adjustments

Refund discrepancies

adapt much faster. This is where systems-first thinking quietly creates an edge , something Rekonsile has consistently emphasised across seller ecosystems.

Common Mistakes Sellers Are Making Right Now

Despite the opportunity, several sellers are already hurting themselves.

Over-Scaling Ads

Increased margin does not mean unlimited ad spend. Many sellers are overspending on ads, assuming higher margins will absorb the cost.

Ignoring Returns

Low-ticket products often see higher impulse purchases and higher returns. Ignoring return economics can erase the benefit of the referral fee waiver.

Treating This as a Forever Change

This is the biggest mistake.

Marketplace history shows that temporary incentives are exactly that, temporary.

The Bigger Lesson Behind Amazon’s Fee Waiver

Zooming out, this move reflects something bigger than commissions.

Indian e-commerce is entering a phase where:

Platforms must support seller sustainability

Sellers must operate with financial clarity

Margins matter as much as growth

The referral fee waiver under ₹1000 is a pressure release valve, not a structural reset.

Sellers who understand this will use the opportunity wisely, not emotionally.

The Bottomline: Opportunity, Not Entitlement

Amazon removing referral fees for products under ₹1000 is a meaningful opportunity, especially for sellers who were previously priced out of the low-ticket segment.

But it comes with conditions:

It is valid only till December 31 (as of now)

It does not eliminate all selling costsIt may change again

The sellers who win will be those who:

Stay calm

Stay data-driven

Build adaptable pricing systems

In a marketplace where policies shift but competition never stops, clarity beats excitement every single time.

And that clarity, whether through internal discipline or smarter financial visibility, is what ultimately separates sustainable sellers from reactive ones.